Madrid, July 16th 2014.- Since 2010, when the application of various cost contain-ment measures began to be implemented, which covered different segments of the Spanish pharmaceutical market (especially from Royal Decree Laws 8/2010, 9/2011 and 16/2012), the impact of such measures has been a very tough one where the global prescription market is concerned. But, according to the data included in issue 109 of Farmaindustria’s Monthly Economic Bulletin, the segment of branded medi-cines has been the one which has suffered most of the consequences, with a reduc-tion in its sales of almost a third from 2010, whereas the sales of generics has dupli-cated during this time.

The Bulletin highlights that the dynamism of the generic medicines market contrasts with the crisis in which branded medicines are still suffering, which is explained by the low rates of penetration of innovative medicines, delays in the commercialization of new medicines and regulatory discrimination which is favourable to the dispensing of generic medicines in those cases where there is an INN prescription and an equal price with the corresponding brand.

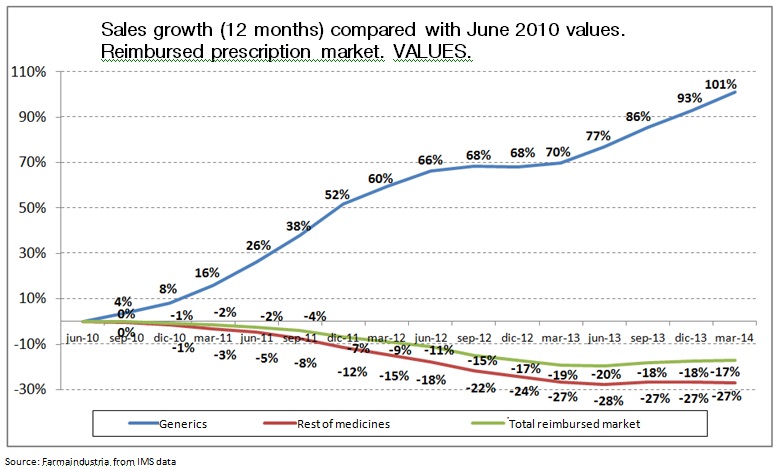

In the period between June 2010 -just before the first RDL came into force- and March 2014, the total market of reimbursed prescription medicines has decreased by 17%, if, when analyzing a breakdown of this figures, it concludes that branded medicines have dropped by 27%, whereas generic medicines have augmented their sales by more than 100%.

The Bulletin also analyzes data referring to sold units and the result is very similar to that in value terms. Thus, even when the total market of reimbursed prescription medicines has decreased by 5% compared to June 2010, the sales in units of generic medicines has increased by 101%, with branded medicines decreasing 30%.

Said reduction in sales of branded medicine units cannot be attributed to the imple-mentation of the new co-payment system since, before it became effective in June 2012, these sales had already decreased by 15% when compared to June 2010.

Family expenditure on pharmaceutical products.

May’s Bulletin also analyses data of the recently published annual survey on House-hold Family Budgets, 2013, which is published annually by the National Institute of Statistics.

According to this survey, the private expenditure in Spanish households on pharma-ceutical products reached 3.713€ millions in 2013. This expenditure includes a wide range of items, including medicines and medical preparations, other pharmaceutical products (patent protected medicines), and includes all expenditure undertaken by Spanish households on non-reimbursed medicines (prescription and OTCs), as well as co-payments for medicines which are reimbursed by public funds.

Thus, in per capita terms, the expenditure on the above products implied costs of 80.47€ per habitant in 2013, a 0.75% of the total expenditure in Spanish households last year. The Bulletin also highlights that in comparative terms, private expenditure on pharmaceutical products is similar to that spent on landline phones (84.42€ per capita) […] and it is well below the average spent on the following in Spanish households: i) bread (119.28 €); ii) tobacco (143.05 € per capita); iii) mobile phones (161.16 €); iv) eating out at restaurants (221.87 € per capita), or v) drinks at bars and cafes (442.65 € per habitant /year).

| We innovate for people

| We innovate for people